Every end product or service is always followed by a footprint of associated resource, energy and emission. Actions to reduce these footprints make business sense, as they can lower energy requirements and ultimately, the price of the end products/services.

Businesses with a vision to identify and act on the opportunities, while managing the risks, are going to be well placed to meet current and future market challenges. The early movers, with their actions and innovations, will not only reduce their overall carbon footprint, but will also have a competitive advantage.

According to the Carbon Disclosure Project (CDP), 2010, more than 84% of the top 200 industries which responded to the survey have put in place or assigned a senior level committee or an executive body to develop their climate change strategy. In addition, companies are becoming more transparent and increasingly sharing information with stakeholders on their actions to mitigate climate change. CDP 2010 responses from Indian companies suggest that there has been a paradigm shift in emphasis from an approach dominated by risk, to one that now embraces opportunity.

Among the most frequently cited policy concerns as regulatory risks are the Kyoto Protocol, National Action Plan on Climate Change (NAPCC), Perform Achieve & Trade Scheme and ECBC (Energy Conservation Building Code)Guidelines. But a few of the industries also anticipate opportunities for their organisations emerging from climate regulation domestically and internationally. Technology solution providers also foresee the opportunity of developing innovative solutions to help society adapt to climate change. Indian companies with a portfolio of products designed to curb emissions and energy intensive practices are already accounting for sizable profit linked opportunities.

The CDP 2010 also shows that although India has not yet mandated any GHG emissions reduction targets for industrial sectors, Indian businesses have been proactive in setting their own Voluntary Reduction Targets. This positive approach by the Indian industry creates a conducive environment for future regulatory policies and sustainable development.

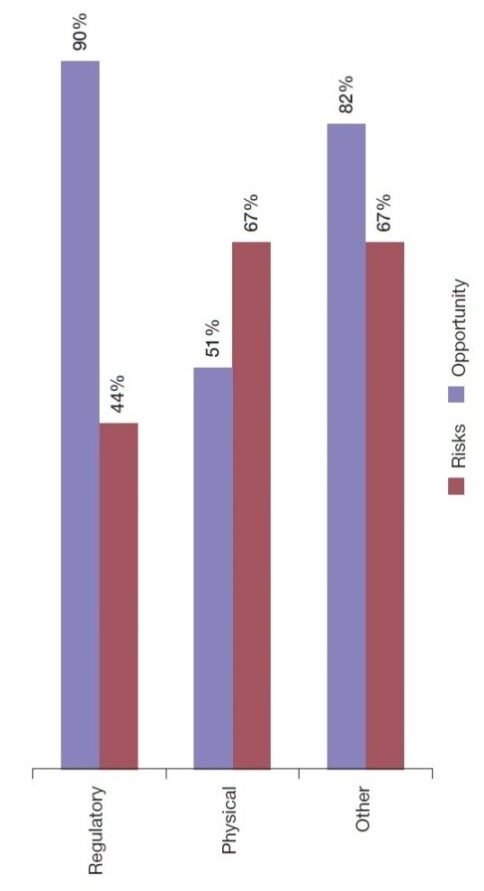

Risks & Opportunity Analysis (CDP 2010)

Regulatory Risks (CDP 2010): The regulatory risks have emerged due to India’s non-Annexure 1 status under the Kyoto Protocol and the lack of any statutory derivatives for mandatory GHG emissions reductions. The companies or sectors that fail to adjust to a changing business environment created by new regulations fall into competitive disadvantages, and the regulatory uncertainties make it difficult for the companies to plan their future.

One of the highlighted impacts of direct regulatory risks is the likelihood of additional financial responsibilities in terms of capital investment required for energy efficiency and carbon abatement projects. Apart from this, another theory says that in future, non-compliance with regulatory guidelines may also lead to financial penalties, which shall further create an impact as a regulatory risk for the industries.

Physical Risks (CDP 2010): As per the CDP 2010 review, extreme weather conditions shall have a major impact on the value chain of the industries, leading to increase in fuel and utility overheads. Failure of electronic and telecommunication networks due to unwanted conditions places certain industries in a position of vulnerability.

Companies believe such unpredictable phenomena, categorized as physical risks, contribute significantly towards loss of productivity and sales. These factors have prompted companies to invest in sustainable raw materials and renewable energy technologies.

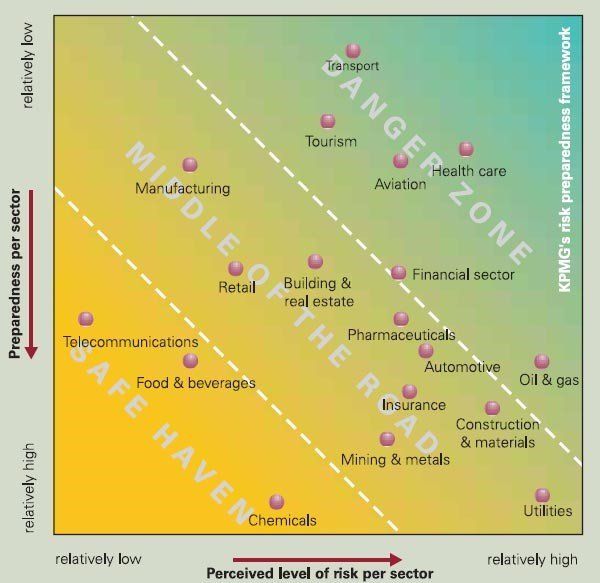

Reputation & Litigation Risks (KPMG 2007): Risks of this type are mainly faced by industries which lack transparency in their disclosures on environmental performances and are more vulnerable to negative public impression. Relatively, the degree of risks cited by the companies in this segment is fewer, but the scale and scope of such factors seem to be on the rise.

Opportunities (KPMG 2007)

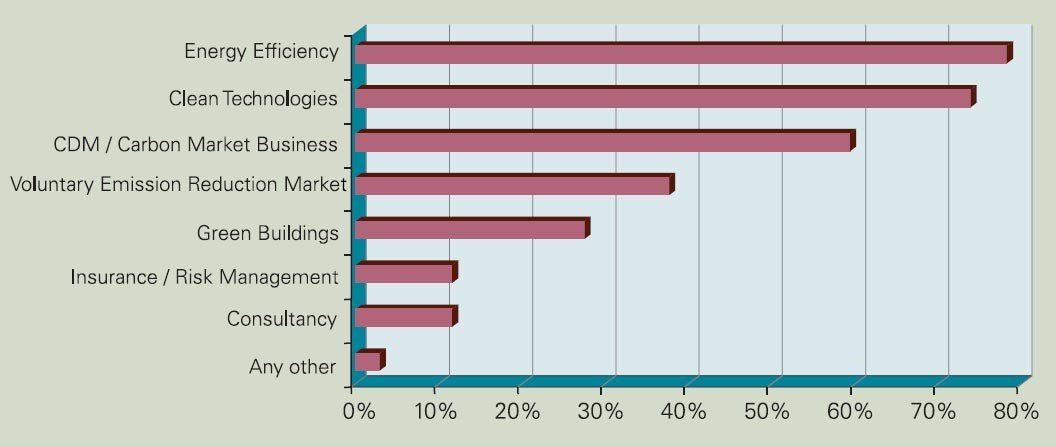

As quoted by Bernard Wientjes, Chairman of the Netherlands Confederation of Industry and Employers, ‘Business can be the solution’. In an open and global economy, a competitive position is necessary if long term investment is to be secured. A report issued by KPMG in 2007 shows that Indian companies can exploit numerous business opportunities that are likely to arise out of climate change mitigation and adaptation. The global market for low-carbon technologies is estimated to grow to USD 3 trillion a year by 2050 (KPMG, 2008; European Commission, 2007), throwing up significant commercial opportunities.

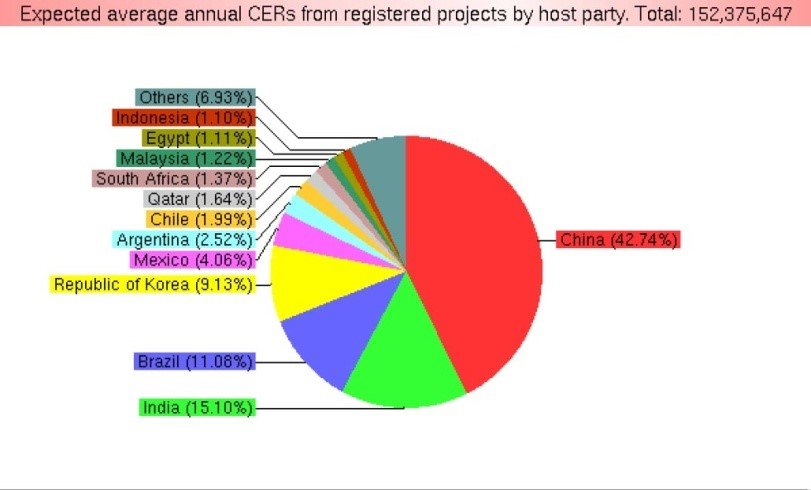

Further, the Clean Development Mechanism (CDM) under the Kyoto Protocol affords businesses in developing countries like India the opportunity to reduce their emissions with the technological and financing support of entities in developed countries. Also, reducing emissions at the firm level has been established to result in significant efficiency gains in various business processes (KPMG, 2008).

Indian industries have grabbed the opportunity provided by the Clean Development Mechanism (CDM) with both hands. A survey conducted by UNFCC shows that about one fifth of all Certified Emission Reductions issued so far have been from India (Bhushan 2009, p19).

Regulatory Opportunities (CDP 2010): In the context of the Kyoto Protocol, generation of green revenue through the Clean Development Mechanism (CDM) has been found to be the most frequently identified regulatory opportunity. Apart from profits through sale of Certified Emission Reductions (CERs), opportunities to build corporate reputation and energy savings are some of the other benefits companies derive through CDM projects.

As per the CDP 2010, some of the companies are also finding that the National Energy Labelling Program, which pertains to product labeling regulation and standards, stimulates demand for new and improved products. Opportunities for financing energy efficiency and renewable energy projects are unanimously observed by banks and diversified financials.

Physical Opportunities (CDP 2010): There are two significant emerging trends as derived by the survey conducted by CDP 2010. In the first case, adaptation to adverse climatic impacts favorably influences the demand for certain products and services. The second trend pertains to indirect opportunities associated with the supply chain.

A majority of the companies recognize opportunities to provide goods and services that may enable others to adapt to the physical consequences of climate change. Supply chain opportunities arise when a company stands to gain from logistical disruptions in its competitors’ supply chains. In such cases, favorable product availability essentially translates to better sales margins.

Other Opportunities (CDP 2010): These can be broadly classified as benefits through reputational gains and market opportunities. Reputational gains are obtained when there is a positive enhancement in an organisation’s corporate image as a result of its conscientious and proactive stance on climate change. Companies with a strong environmental performance can enjoy certain competitive advantages related to reputation (Bali et. al. 2010).

Companies adopting best practices and processes are well rewarded in terms of improved energy efficiency, monetary savings and reduced emissions. If these carbon savings were to be sold on CER markets, they would fetch even higher returns. The carbon market, therefore, presents new opportunities for the Indian business sector (Bali et. al. 2010).